Our season of decline.

For most of us yesterday was the day that we filed our income tax returns. It marked the end of “tax season,” an unfortunate label arising from the fact that the tax code is so complex, and requires such a huge diversion of otherwise productive energy, that an actual “season” for it is required.

How much time did you spend on your taxes? How many of you had to hire someone to help you lest you make a mistake and find yourself in the crosshairs of the IRS?

It may surprise you to know that nearly half of your fellow citizens, 47 percent to be exact, are happily exempt from that heartache, up from 40 percent just five years ago.

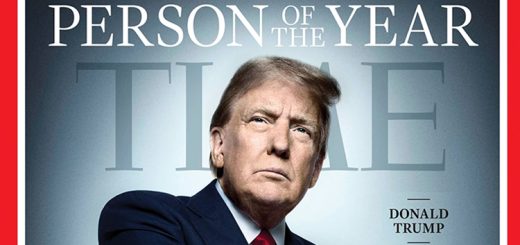

By 2012, when we again select a president, it is entirely possible that the number of those voting who don’t pay income taxes will outnumber those that do. This is true despite the fact that government spending has exploded and the deficit has nearly quadrupled in just two years.

Two hundred thirty five years ago on Sunday, the “Shot Heard Around the World” was fired at Lexington, Massachusetts, marking the beginning of the American Revolutionary War. That was a war fought over the objection to taxation without representation.

Today, we are moving rapidly toward representation without taxation.

We have bigger government, bigger bureaucracy, bigger deficits and bigger debt all borne by a shrinking proportion of citizens who actually pay taxes.

This is not really a tax system at all. It is a legal mugging. It is government-sanctioned class and generational warfare. The shrinking tax roll is a cancer eating at the very morality of taxation.

If you are one of the ones still paying taxes, it is fair to ask what you’re getting in return for your continued fiscal rectitude.

Today 20 percent of all American households derive three quarters or more of their household income from the federal government. Another 20 percent rely on the federal government for 40 percent of household income. Thus four out of ten Americans are now dependent on the federal government and that’s before the implementation of ObamaCare.

At one time, Americans paid their taxes and got something tangible and useful in return. The Interstate Highway System comes to mind. We paid our taxes or purchased savings bonds and things got done.

When the Allies needed oil to fight World War II, we laid a 24-inch pipeline from Longview to Linden, New Jersey in just 54 weeks and used the resources of the East Texas oil field to help gain victory over a murderous tyrant.

We paid our taxes and put men on the moon.

In a cruel irony it being tax day yesterday, President Obama gave a speech to employees at the Kennedy Space Center at Cape Canaveral, Florida in which he tried to explain how the ending of America’s manned space program and the ending of 7,000 or more of their jobs is good for America.

The nation that led the way in space will soon have to go hat in hand to Russia (together with a check for $51 million per head) in order to thumb a ride into space. President Kennedy said in a speech at Rice University in September 1962 that the exploration of space will go ahead, whether we join in it or not. He was right. Ask China and Russia.

But it’s not about spaceflight per se. It’s about the larger issue of ceding our leadership in the world. Stay on this course, and one by one, in every area of business, technology, medicine, manufacturing, science, commerce and military power, where America is now the leader, that leadership will be sacrificed upon the altar of redistribution and entitlement.

Today 53 percent of Americans are propping things up not only for the other 47 percent but for most of the rest of the world. What happens to America when 51 percent of non-taxpaying citizens outvote 49 percent of citizens who still pay taxes? What happens when 60 percent outvote 40 percent? Or 70 percent outvote 30 percent?

At some point, very soon, the tipping point will be reached and those who continue to strive and work and invest and hire and generate taxable income will just decide it’s not worth it.

When that happens, how will what we leave our children compare to what we inherited?

Who will lead the world then?

Being a self-employed stock trader my tax prep was counted in weeks, not days or hours. The current system is insane. IMO, we need either a flat tax w/ no deductions or credits or a national sales tax w/ the complete elimination of income taxes. It would also be “fair” to see some of those persons making less than 50-100 K (or whatever the figure may be) actually pay a share of the federal tax instead of letting it rest on the shoulders of those who, for whatever reason, earn more.

Paul is right when he said: “Today, we are moving rapidly toward representation without taxation”. I would modify the statement to read “FAVORITISM without PROPORTIONAL taxation”. This is just another symptom of big government injustices (FAVORITISM, TAXATION, LAWS, and REGULATIONS) being thrust upon us WITHOUT Constitutional REPRESENTATION. Let me introduce you to a term that we don’t hear much about these days: TREACHERY.

TREACHERY is the willful betrayal of fidelity, confidence, or trust. It is also the violation of allegiance or violation of faith and confidence.

It is time to re-introduce this term into our society as a description of the hidden agenda to place us under a tyrannical form of government by many of our elected, so-called representatives. There is simply no other way to explain the reduction in our liberties to conduct our personal affairs, free from heavy-handed government intervention. Government mandated behavior is being forced upon us by the threat of taxation and fees (maybe jail) if we are found in violation of some bogus regulation that is NOT part of REAL representative government.

Simply stated, we citizens of America are the victims of TREACHERY as conducted by many of our elected representatives who have VIOLATED their oath “to uphold and defend the Constitution of the United States of America”. Let me explain.

If a federal law is PASSED that affects your behavior (rights as citizens) that was written by a bunch of unelected elite technocrats (lobbyists and other Socialist/Marxist miscreants from labor unions, academia and the favored staff of certain powerful Democrat committees) that was never debated, read, or understood by the Congress or President, then we have effectively been placed under their rule without the “consent of the governed”. This is a patent violation of our form of representative government as established by the Constitution. This is simply tyranny of the oligarchy. Oligarchy is government by the few and is characterized by the despotic power exercised by a small and privileged group for corrupt or selfish purposes. Oligarchies have been tyrannical throughout history, being completely reliant on public servitude to exist. This is the most fundamental violation of the Constitution imaginable by the willing participation of those representatives who have engaged in this treachery.

The tax code (Title 26 of the US Code of Federal Regulations) is a 97 year evolution of favoritism and unequal treatment under the law. If you think the recently passed ObamaCare law of nearly 3000 pages that nobody in representative government understood is ridiculous, how can 70,000 pages of rules contained in the tax code be considered Constitutional either? Can we be held accountable to laws that are beyond comprehension and are themselves a patchwork of special provisions to rob from one segment of society for the benefit of another? In 1913, all federal tax regulations were contained in 400 pages. In 2010 it takes 71,684 pages to fully describe the tax code including all associated regulations, forms, publications, etc. A chart at the following link illustrates this travesty: http://www.cch.com/wbot2010/WBOT_TaxLawPileUp_%2829%29_f.pdf

You can download Title 26 of the US Code (Internal Revenue Code) at: http://uscode.house.gov/download/title_26.shtml which requires 8,969 pages to print. Is this the result of Constitutional representative government that provides equal justice under the law? Clearly, this is the result of an unchecked oligarchy, run amok for decades! Our representatives have been too weak to stop them or worse yet, have been engaging in treachery themselves. We must make our fellow citizens aware of this abdication of Constitutional responsibility and insist on a return to a genuine representative republic. Otherwise, our country will join all the tyrannies that have dominated the history of mankind.